For application submitted before 26 March 2021 you can check the status via httpsemlmidagovmyincentive. The waste generated in Malaysia in 2005 was 19000 tons per day at a recycling rate of 5.

Net Energy Metering Schemes Solar Sunyield

The quantity rose to 38000 tons per day thirteen years later in 2018 despite the increased recycling rate of 175.

. Due to the cultural difference the idea of exit after 2-3 years of investment banking isnt valid here. The amount paid as LTA is tax-free under Section 105 of the Income Tax Act 1961 with Rule number 2B. Indonesia aims for net zero emissions by 2060 whilst Thailand by 2070.

The western landmass known as Peninsular Malaysia is bordered to the north by Thailand and to the south by Singapore while the eastern landmass East Malaysia is bordered by Brunei and Indonesia. People come into investment banking for a long-term and they stay for a long period of time. To stimulate business investment the Finance Act 2019 increased the annual investment allowance to GBP 1 million.

Malaysia is separated into two landmasses by the South China Sea. There are many factors that one needs to keep in mind. Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA.

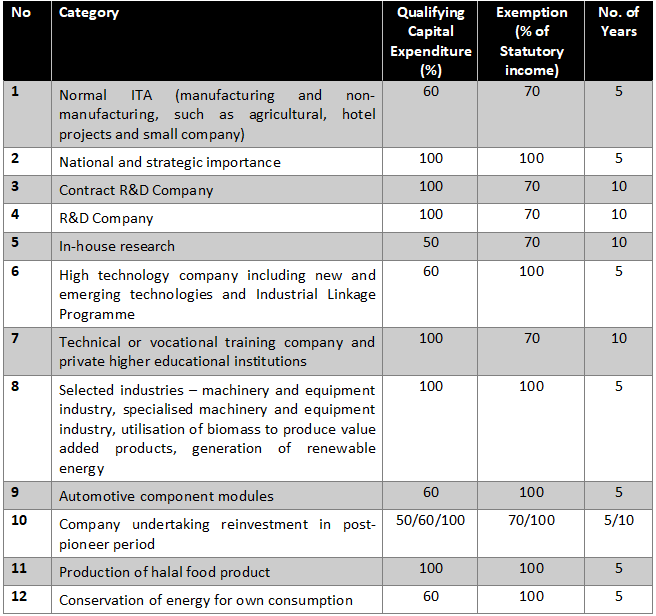

Investment Tax Allowance ITA. If you are staying in a rented house and getting House Rent Allowance as a part of your salary you can claim for fullpartial HRA exemption as per the Section 10 of IT Act. It is an alternative to PS but comes in the form of additional relief of 60 of the qualifying capital expenditure QCE incurred to be set-off against 70 of SI.

For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. Even though Leave Travel Allowance sounds simple but it is not. Investment Banking in Dubai Exit Opportunities.

So if you talk about exit opportunities people rarely look for them once they get into banking. On the other hand HRA is taxable if you are. Computation of tax charged click here.

All businesses regardless of size can claim an annual investment allowance of 100 on the first GBP 1 million per year of most qualifying expenditure. A company may apply for tax incentives under the Promotion of Investments Act 1986 or Income Tax Act 1967 subject to the fullfilment of the criteria. With fast-growing cities and ballooning population developing countries like Malaysia are facing numerous challenges in sustainably managing wastes.

General Like PS ITA is an incentive measure available only for promoted products or promoted activities. A recent initiative in the 12th Malaysia Plan highlights carbon tax credits taxing companies burning fossil fuels by volume or weight of emissions. House Rent Allowance HRA is an added benefit that is offered by an employer to its employees.

Therefore the remaining amount is taxed under the slab rates of the income tax. Claims for capital allowance can be made in the relevant column provided in the Tax Return Form. In determining the business adjusted income during the basis period no deductions are allowed for expenditures which are capital in nature or depreciation value for the assets which are used in the production of that business income.

Decoding HRA Tax Exemption. However it has a pre-specified limit. Malaysias carbon neutral goal by 2050 places it ahead of its Southeast Asian peers in carbon commitments.

With its coming. This is alarming as. An important gateway to lucrative regional markets Malaysia has a developed economy that has grown over the past.

This is restricted to a single allowance for groups of companies or associated businesses. From the date of approval up to a period of 5 years 60 of the QCE or Qualifying Capital Expenditure should be offset against 70 of the statutory income for every year up to hen YA will be fully utilized.

Tax Incentives For Green Technology In Malaysia Gita Gite Project

The Green Investment Tax Allowance Gita Maqo

Tutorial 1 Investment Tax Allowance Ita Ra B I Investment Tax Allowance Delight Star Sdn Studocu

Chapter 5 Investment Incentives

Tax Incentives In Malaysia The Potential Impact Of The Implementation Of G7 Global Tax Reform

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Do You Run Or Own A Green Penang Green Council Facebook

How Does The Green Investment Tax Allowance Gita Work Solarvest

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

The Green Investment Tax Allowance Gita Maqo

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Solar Double Tax Exemption 50 Off Capex For Businesses

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Malaysian Investment Development Authority 30 August 2016 Incentives And Grants Ppt Download

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

What Is An Investment Holding Company And When Is It Useful

- wanita hari ini

- jenis warna tinted kereta

- perkahwinan orang melayu

- ayat ibrahim muka surat

- tm streamyx customer service

- daun patah tulang dan manfaatnya

- boleh ke ada dua nama dalam geran kereta

- nama nama jepang perempuan

- salon rambut setia alam

- vista pinggiran taman equine

- surah alam nasrah

- no pusat kad kredit bank rakyat

- sample acknowledgement for thesis

- jpn klang

- tanda hamil anak perempuan menurut islam

- ulu sungai merah 8

- u mobile microcredit

- gambar kasut kartun hitam putih

- lc 150 biru mirror

- kementerian pendidikan melaka